Since its emergence in Asia late 2019, the coronavirus COVID-19 pandemic has been devastating. The virus spread to most countries causing severe respiratory infections and many human casualties. The virus also put half of the world population in lockdown which resulted in a slowdown of the world economy and a fall in stock prices.

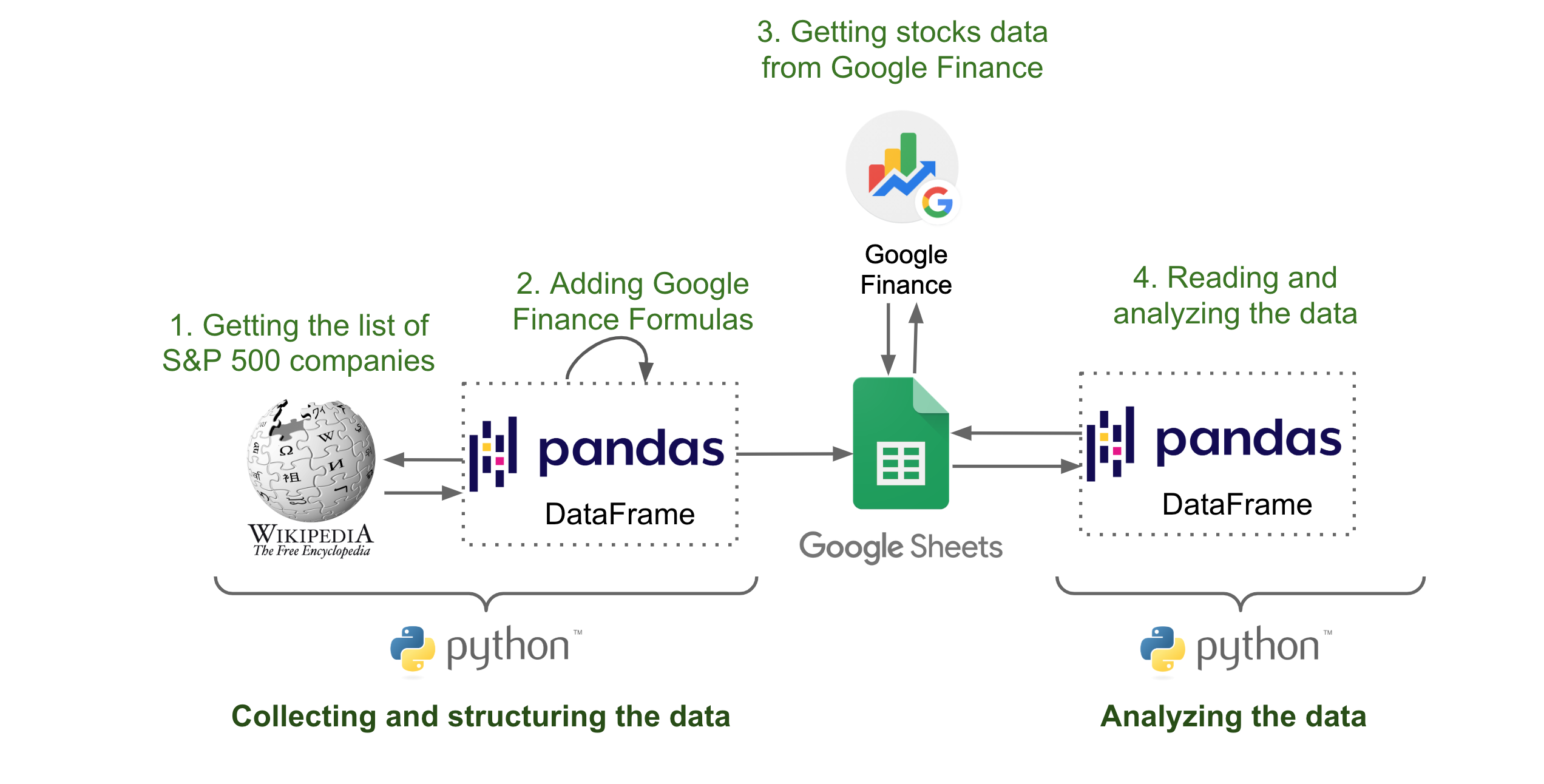

The goal of this tutorial is to introduce the steps for collecting and analyzing stock data in the context of the coronavirus pandemic. To do this, we will use Python, Google Sheets and Google Finance.

In section 2 of the the tutorial, we will see how to configure Google Sheets in order to be able to interact with them using Python. In section 3, we will see how to collect stocks data using Google Finance and how to store this data in Google Sheets using Python. In section 4, we will see how to read the data from Google Sheets and analyze it using Python and Pandas.

The source code for this tutorial can be found in this github repository.

1. The Case Study¶

In this tutorial, we will focus on the S&P 500 companies. We will start by collecting the following data :

- Stock prices in 3 different dates (January 1st, March 23rd and April 9th)

- Number of outstanding shares for each company

- Industry/Sector where the companies operate (following the GICS classification)

After collecting and structuring the data, we will use Python and Pandas library to analyse the data.

2. Technical Setup¶

We will be using the following services and libraries to collect and analyze the data:

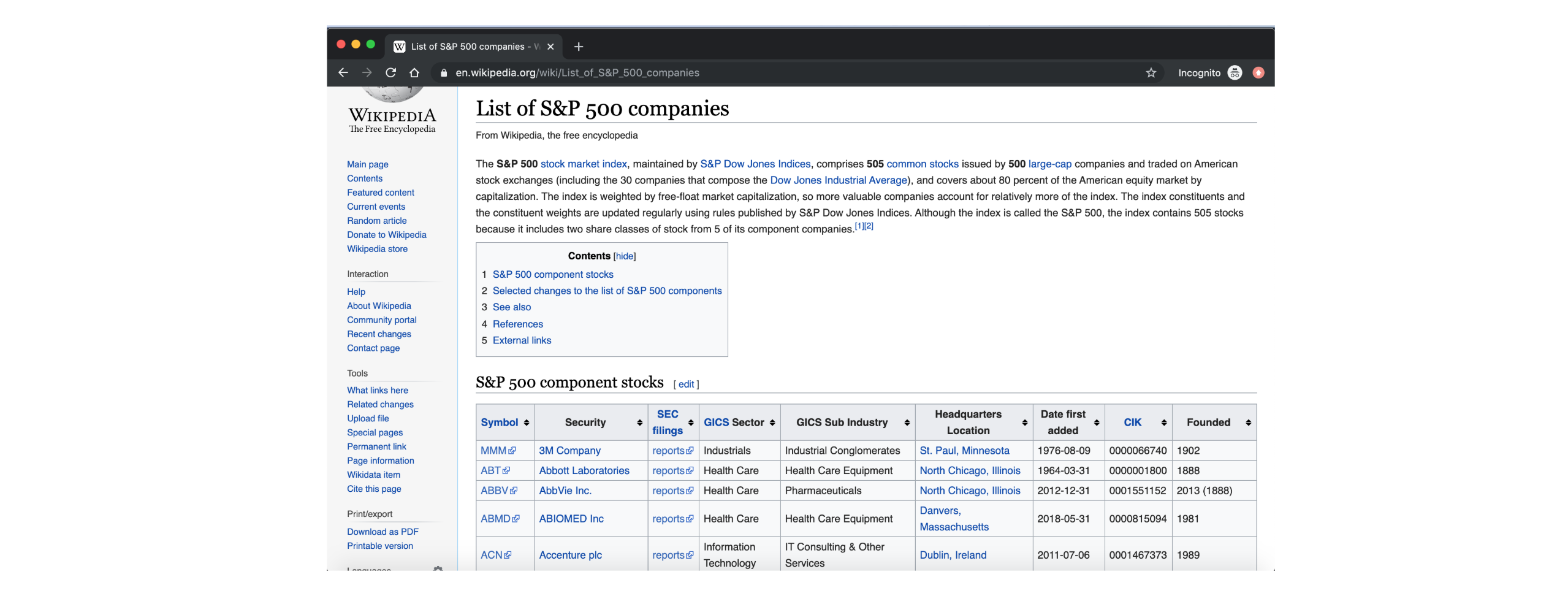

- Wikipedia: We will use this wikipedia page to get the list of S&P 500 companies.

- Google Finance: Google Finance is a website focusing on business news and financial information hosted by Google [1]. Google Finance doesn't have an API that we can use directly in Python, but it can be accessed from Google Sheets using a formula called GOOGLEFINANCE. We will use Python to write down the GOOGLEFINANCE formulas.

- Goole Sheets: We will use Google Sheets as a backend to store stocks data. In order to interact with Google Sheets directly from Python, we need 3 libaries: Google Auth, gspread and gspread-pandas. We also need to configure Google Sheets to be able to access the spreadsheets using Python.

- Python and Jupyter notebooks and Pandas: We will be using Python, Jupyter notebooks and Pandas to collect, store and analyze the data.

2.1. Google Sheets Configuration in GCP¶

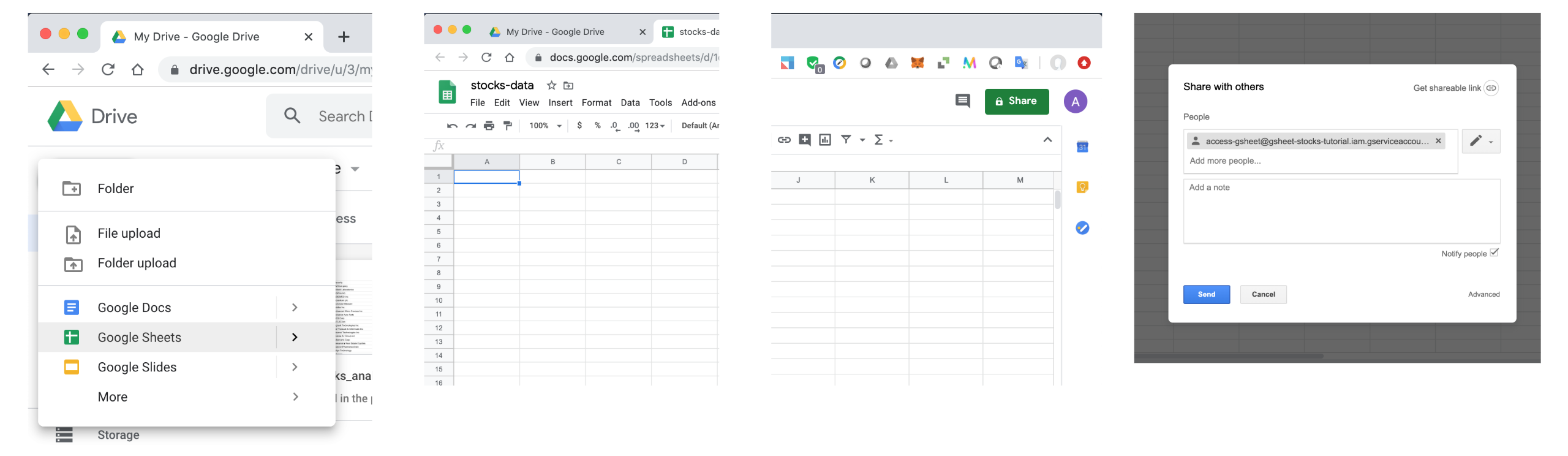

In order to access Google Sheets from Python, we need a private key from Google Cloud Platfrom (GCP) that we can obtain using the following steps.

- Step 1: Go to Google Cloud platform, log in using your google account and click on

Console.

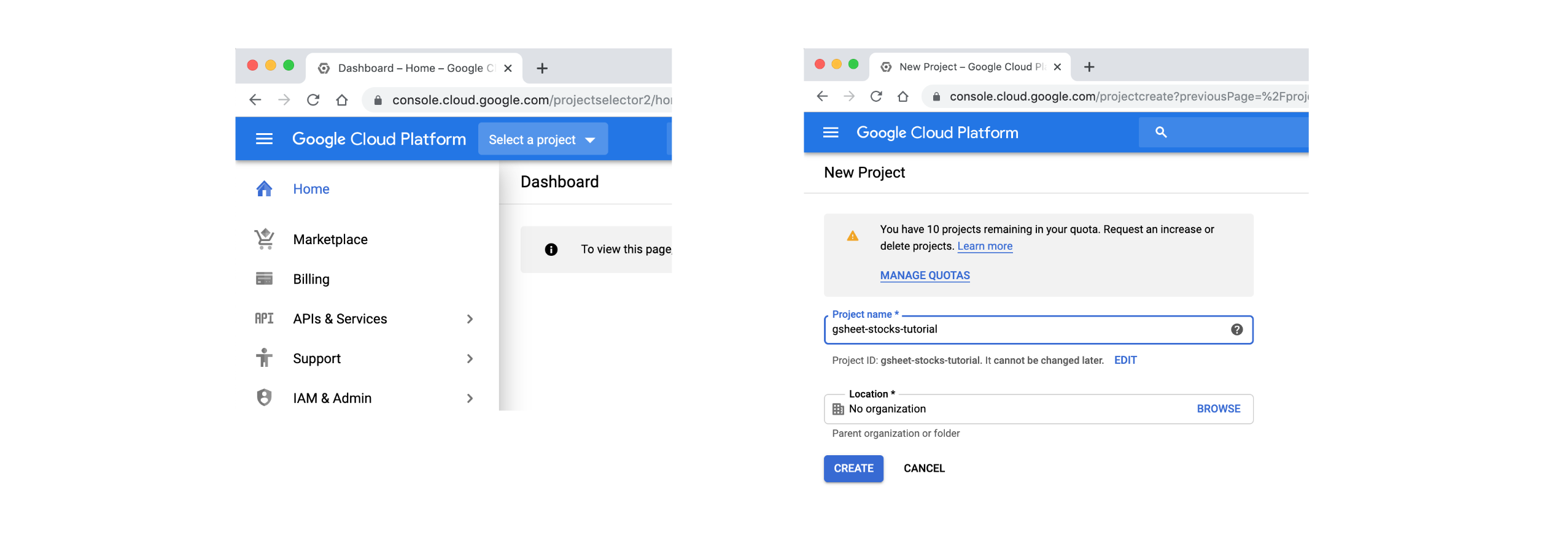

- Step 2: Click on

Select a project>NEW PROJECT, enter the project name and click onCREATE

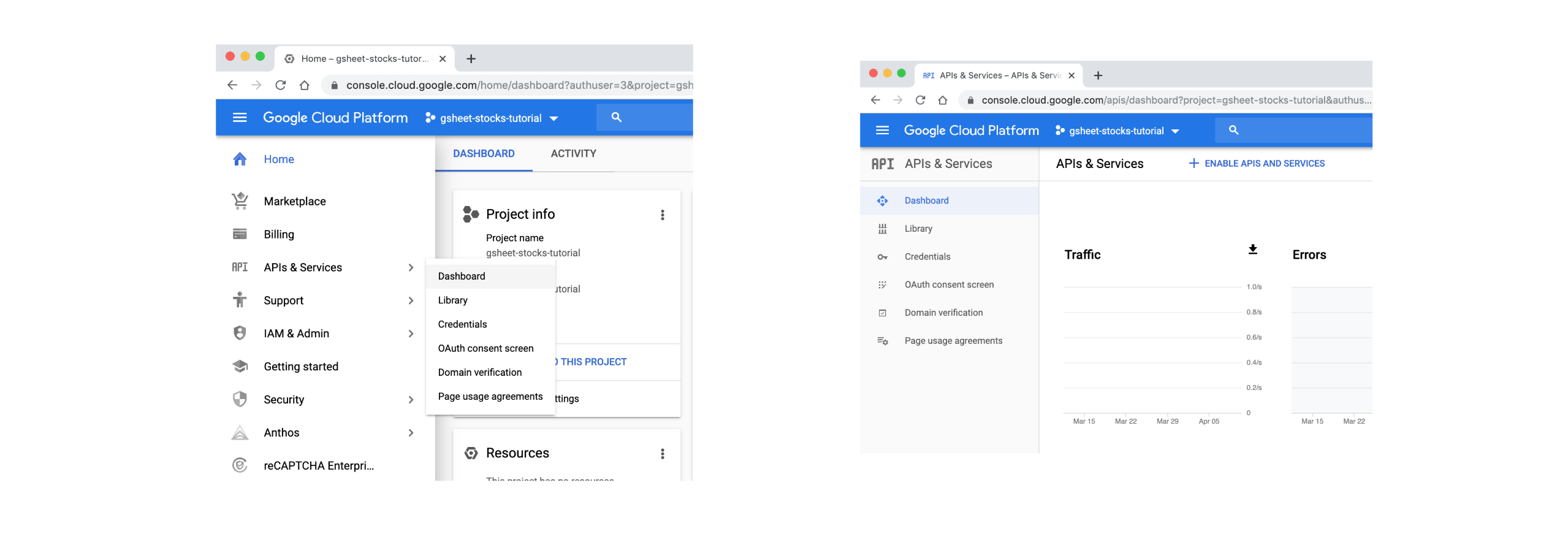

- Step 3: Click on

APIs & Services>Dashboard>ENABLE APIS AND SEVICES.

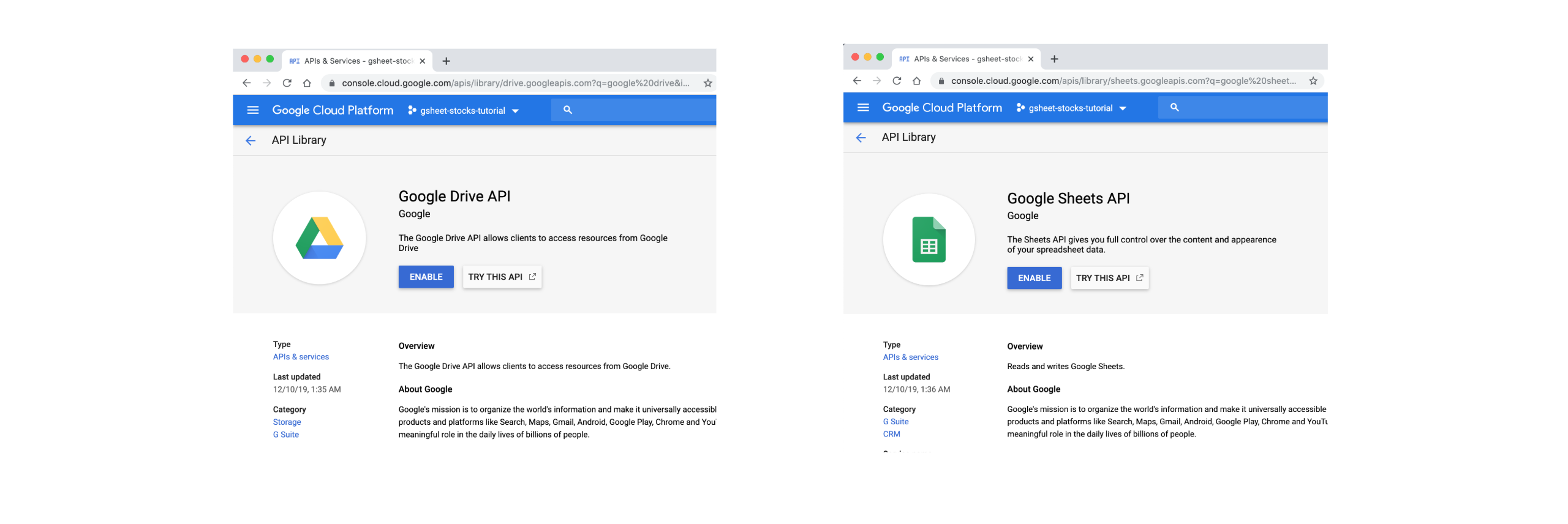

- Step 4: Search for both Google Drive API and Google Sheets API and click on

ENABLE

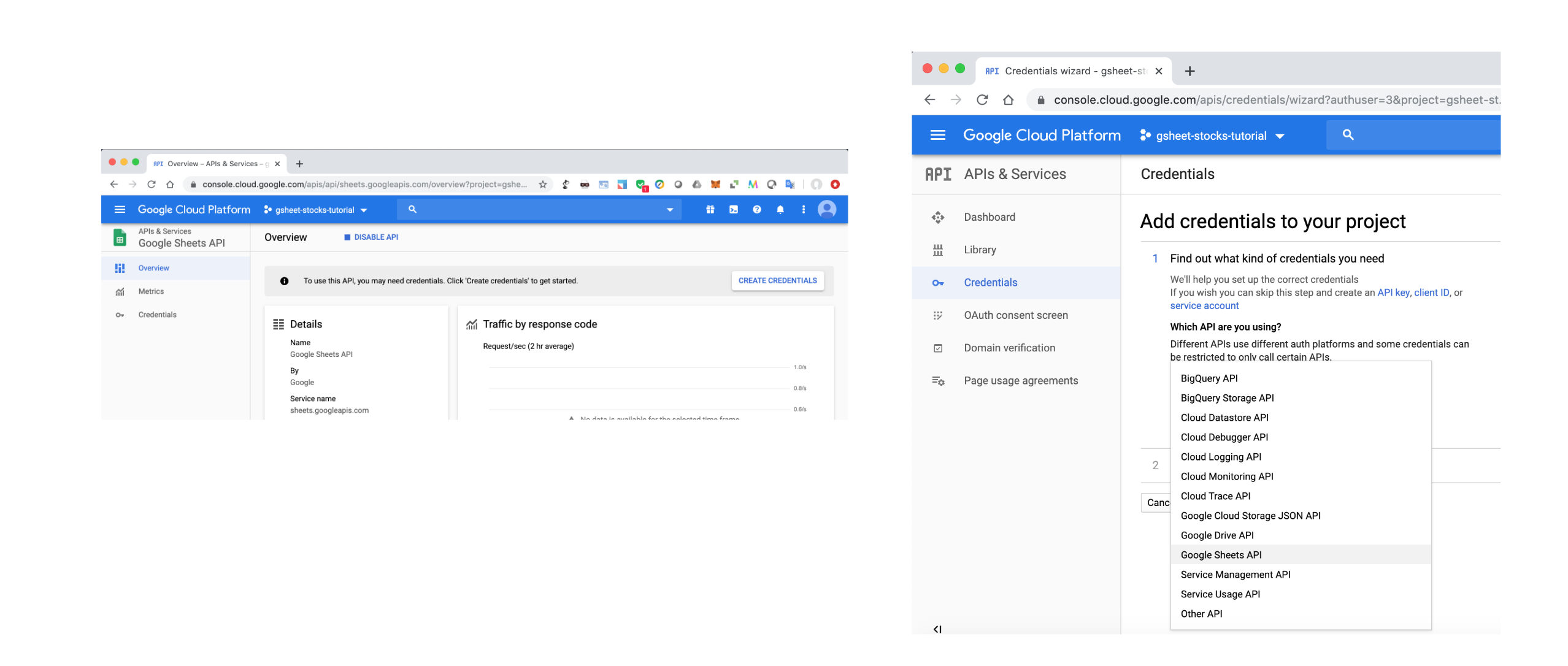

- Step 5: Inside the Google Sheets API page, click on

MANAGE,CREATE CREDENTIALSand selectGoogle Sheets API.

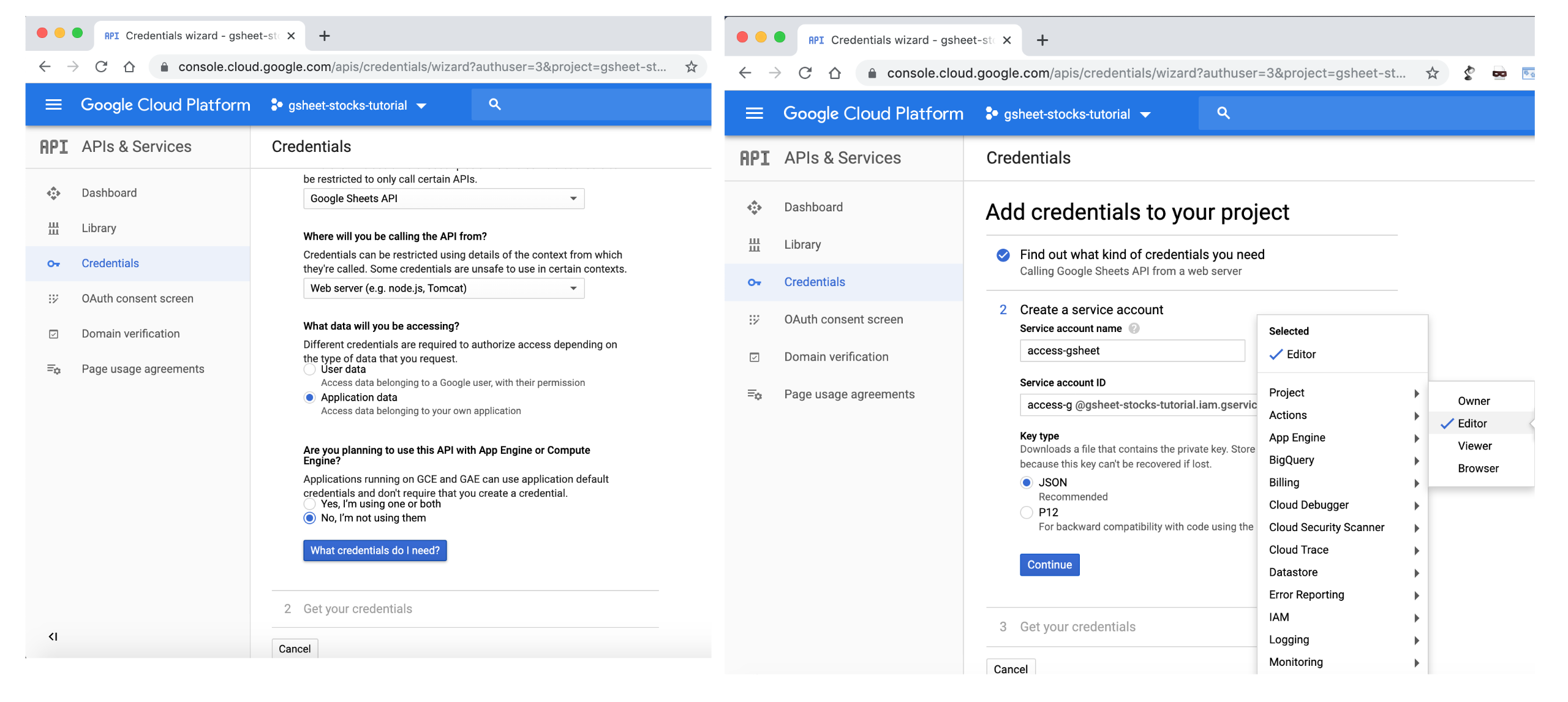

- Step 6: Choose

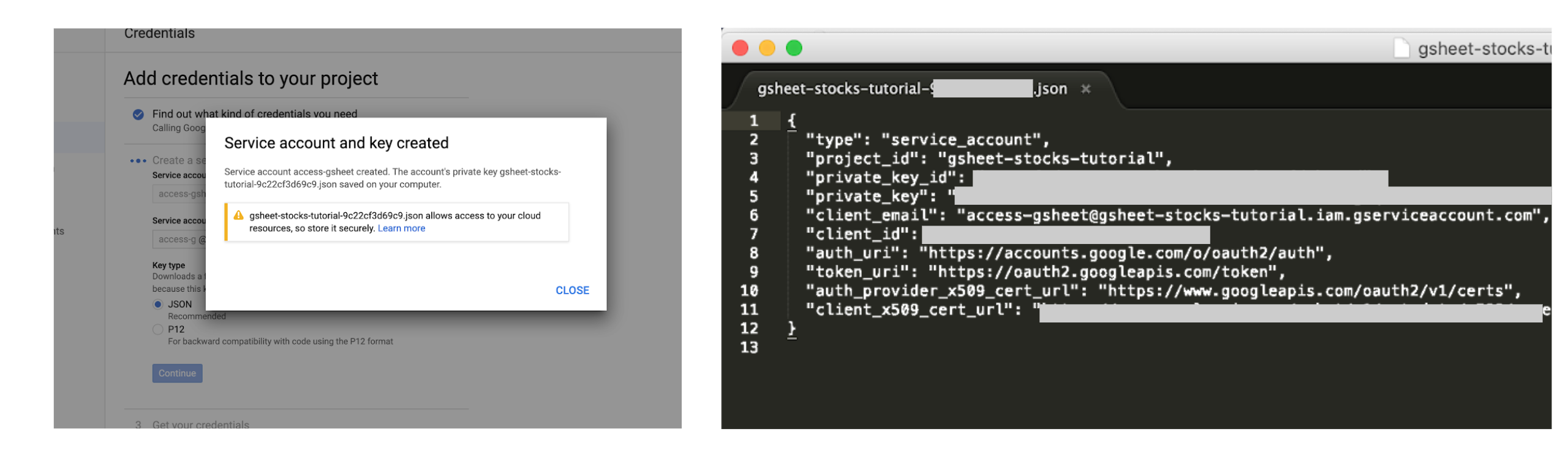

Web sever,Application dataandJSONtype for the API key. ClickContinueto download your private key in JSON format.

- Step 7: Once you download the JSON file, save in the same folder as your Jupyter notebook and copy the

client_emailinformation.

2.2. Google Sheets Configuration¶

As a last step, we need to create a new Google sheet and share it with the client_email that we created in the previous step. Open Google Drive, create a new Google Sheet, change its name to "stocks-data". Click on Share button, enter the client_email and click Send.

3. Collecting and Storing Stocks Data¶

Now that we have our google Sheets configured, we can start using Python and Jupyter Notebook to collect the data. We start by importing the different libraries that we need.

%matplotlib inline

import pandas as pd

import gspread

from google.oauth2.service_account import Credentials

from gspread_pandas import Spread, Client

import seaborn as sns

import matplotlib.pyplot as plt

plt.style.use('fivethirtyeight')

Getting the list of S&P 500 companies from Wikipedia¶

As a first step in the data collection effort, we need to get the list of S&P 500 companies. To do this, we will use the following Wikipedia Page: https://en.wikipedia.org/wiki/List_of_S%26P_500_companies

Fortunatey, we can use Pandas to read the page, extract the table with S&P 500 companies and store them into a Pandas Dataframe.

url = 'https://en.wikipedia.org/wiki/List_of_S%26P_500_companies'

stocks_df = pd.read_html(url, header=0)[0]

stocks_df.head()

| Symbol | Security | SEC filings | GICS Sector | GICS Sub Industry | Headquarters Location | Date first added | CIK | Founded | |

|---|---|---|---|---|---|---|---|---|---|

| 0 | MMM | 3M Company | reports | Industrials | Industrial Conglomerates | St. Paul, Minnesota | 1976-08-09 | 66740 | 1902 |

| 1 | ABT | Abbott Laboratories | reports | Health Care | Health Care Equipment | North Chicago, Illinois | 1964-03-31 | 1800 | 1888 |

| 2 | ABBV | AbbVie Inc. | reports | Health Care | Pharmaceuticals | North Chicago, Illinois | 2012-12-31 | 1551152 | 2013 (1888) |

| 3 | ABMD | ABIOMED Inc | reports | Health Care | Health Care Equipment | Danvers, Massachusetts | 2018-05-31 | 815094 | 1981 |

| 4 | ACN | Accenture plc | reports | Information Technology | IT Consulting & Other Services | Dublin, Ireland | 2011-07-06 | 1467373 | 1989 |

The most important data that we need is:

- Symbol: Stock Symbol

- Security: Name of the company

- GICS Sector: Sector where the company operates following the Global Industry Classification Standard (GICS).

- GICS Sub Industry: Sub industry where the company operates following the Global Industry Classification Standard (GICS).

We can start looking at some statistics. For example the number of companies in the list.

#Number of companis

len(stocks_df)

505

We got 505 companies in our list, and not 500... This is because some companies have a dual-class stock structure and are listed more than once in the list. We can get the list of these companies by searching for the word "Class" in their security name.

stocks_df[stocks_df['Security'].str.contains("Class")]

| Symbol | Security | SEC filings | GICS Sector | GICS Sub Industry | Headquarters Location | Date first added | CIK | Founded | |

|---|---|---|---|---|---|---|---|---|---|

| 24 | GOOGL | Alphabet Inc Class A | reports | Communication Services | Interactive Media & Services | Mountain View, California | 2014-04-03 | 1652044 | 1998 |

| 25 | GOOG | Alphabet Inc Class C | reports | Communication Services | Interactive Media & Services | Mountain View, California | 2006-04-03 | 1652044 | 1998 |

| 148 | DISCA | Discovery Inc. Class A | reports | Communication Services | Broadcasting | Silver Spring, Maryland | 2010-03-01 | 1437107 | NaN |

| 149 | DISCK | Discovery Inc. Class C | reports | Communication Services | Broadcasting | Silver Spring, Maryland | 2014-08-07 | 1437107 | NaN |

| 203 | FOXA | Fox Corporation Class A | reports | Communication Services | Movies & Entertainment | New York, New York | 2013-07-01 | 1308161 | NaN |

| 204 | FOX | Fox Corporation Class B | reports | Communication Services | Movies & Entertainment | New York, New York | 2015-09-18 | 1308161 | NaN |

| 340 | NWSA | News Corp. Class A | reports | Communication Services | Publishing | New York, New York | 2013-08-01 | 1564708 | NaN |

| 341 | NWS | News Corp. Class B | reports | Communication Services | Publishing | New York, New York | 2015-09-18 | 1564708 | NaN |

| 457 | UAA | Under Armour Class A | reports | Consumer Discretionary | Apparel, Accessories & Luxury Goods | Baltimore, Maryland | 2014-05-01 | 1336917 | NaN |

| 458 | UA | Under Armour Class C | reports | Consumer Discretionary | Apparel, Accessories & Luxury Goods | Baltimore, Maryland | 2016-04-08 | 1336917 | NaN |

We got 10 companies with dual-class structure in the list. If we take that into consideration, we can see that we have 500 unique companies in the list.

We can also check the number of companies by sector and sub industry.

stocks_df['GICS Sector'].value_counts()

Industrials 71 Information Technology 71 Financials 66 Consumer Discretionary 64 Health Care 60 Consumer Staples 33 Real Estate 31 Utilities 28 Materials 28 Energy 27 Communication Services 26 Name: GICS Sector, dtype: int64

stocks_df['GICS Sub Industry'].value_counts()

Health Care Equipment 19

Electric Utilities 13

Semiconductors 13

Industrial Machinery 13

Packaged Foods & Meats 12

..

Real Estate Services 1

Motorcycle Manufacturers 1

Multi-Sector Holdings 1

Hotel & Resort REITs 1

Drug Retail 1

Name: GICS Sub Industry, Length: 128, dtype: int64

Adding stocks data from Google Finance¶

Now that we have the list of S&P 500 companies, we can add to our DataFrame Google Sheets formulas that will fetch from Google Finance stock prices and the number of outstanding shares for each company. Note that, these formulas will be executed once we save the Pandas DataFrame in our Google Sheet.

You can find the documentation of GOOGLEFINANCE formulas here: https://support.google.com/docs/answer/3093281

We start by adding stock prices in 3 different dates: January 1st, March 23rd and April 9th.

- January 1st, 2020 is the first date of the year. We want to have this price in order to calculate the price drop since the beggining of 2020.

- March 23rd, 2020 is the date when the S&P 500 reached the bottom in 2020.

- April 9th, 2020 is the last date when the stock market was open (at the time of writing this blog post)

stocks_df["Price_1_1"] = stocks_df["Symbol"].apply(lambda x: '=INDEX(GOOGLEFINANCE("' + x + '","price", "1/1/2020"),2,2)')

stocks_df["Price_3_23"] = stocks_df["Symbol"].apply(lambda x: '=INDEX(GOOGLEFINANCE("' + x + '","price", "3/23/2020"),2,2)')

stocks_df["Price_4_9"] = stocks_df["Symbol"].apply(lambda x: '=INDEX(GOOGLEFINANCE("' + x + '","price", "4/9/2020"),2,2)')

Next, we add the formula to calculate the number of outstanding shares for each company. We can use this data with the stock prices to calculate the market cap of companies at the 3 different dates.

stocks_df["Shares"] = stocks_df["Symbol"].apply(lambda x: '=GOOGLEFINANCE("' + x + '","shares")')

Storing the DataFrame to Google Sheet¶

We start by creating a variable that contains our credentials that we got from Google Cloud Plaltform.

scope = ['https://spreadsheets.google.com/feeds',

'https://www.googleapis.com/auth/drive']

credentials = Credentials.from_service_account_file('./gsheet-stocks.json', scopes=scope)

Next, we read the empty google sheet in a variable that we call spread.

client = Client(scope=scope, creds=credentials)

spread = Spread("stocks_analysis", client=client)

We define the list of variables that we want to keep.

cols_to_keep = ["Symbol", "Security", "GICS Sector", "GICS Sub Industry",

"Price_1_1", "Price_3_23", "Price_4_9", "Shares"]

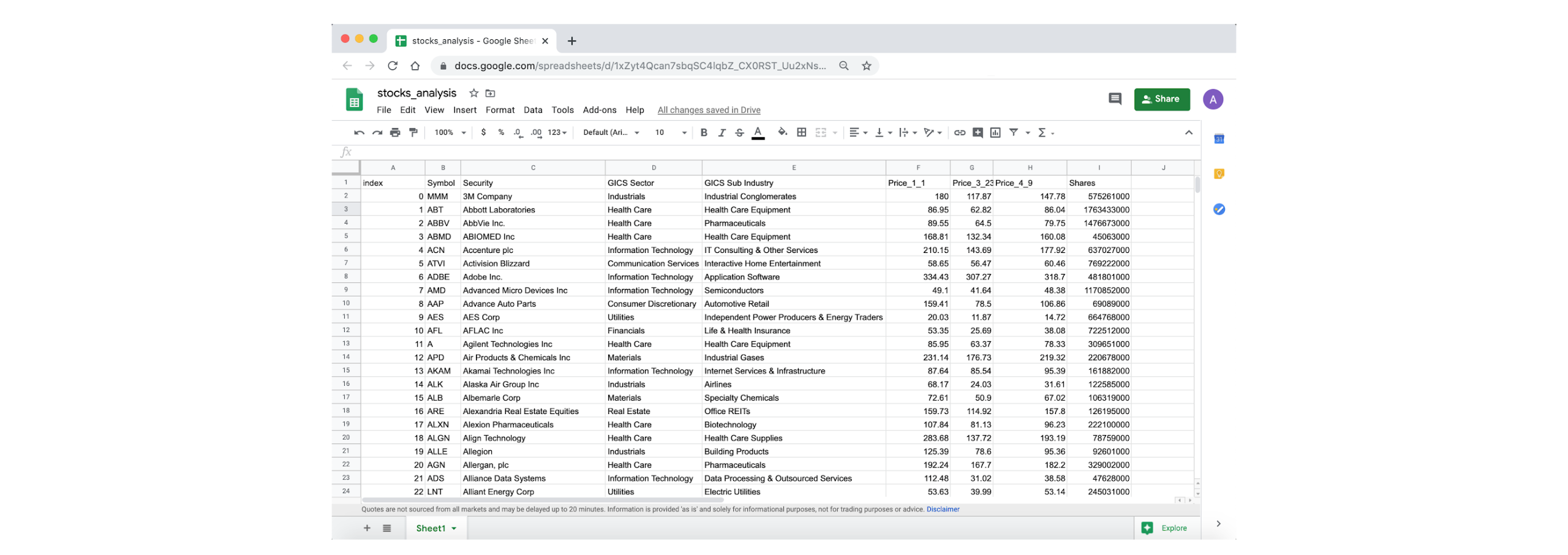

The last step is to save the DataFrame to Google Sheets.

spread.df_to_sheet(stocks_df[cols_to_keep])

If we go to Google Sheets, we can see that the data is correctly stored.

4. Analyzing the Data¶

4.1. Reading the data¶

We start by reading the data from Google Sheets into a new DataFrame.

stocks_df = spread.sheet_to_df()

stocks_df.head()

| Symbol | Security | GICS Sector | GICS Sub Industry | Price_1_1 | Price_3_23 | Price_4_9 | Shares | |

|---|---|---|---|---|---|---|---|---|

| index | ||||||||

| 0 | MMM | 3M Company | Industrials | Industrial Conglomerates | 180 | 117.87 | 147.78 | 575261000 |

| 1 | ABT | Abbott Laboratories | Health Care | Health Care Equipment | 86.95 | 62.82 | 86.04 | 1763433000 |

| 2 | ABBV | AbbVie Inc. | Health Care | Pharmaceuticals | 89.55 | 64.5 | 79.75 | 1476673000 |

| 3 | ABMD | ABIOMED Inc | Health Care | Health Care Equipment | 168.81 | 132.34 | 160.08 | 45063000 |

| 4 | ACN | Accenture plc | Information Technology | IT Consulting & Other Services | 210.15 | 143.69 | 177.92 | 637027000 |

we can see that the DataFrame contains real values for stocks prices and number of shares (and not Google Sheets formulas).

We need to change the data type of stock prices and number of outstanding shares from string to numeric.

stocks_df[["Price_1_1", "Price_3_23", "Price_4_9", "Shares"]] = \

stocks_df[["Price_1_1", "Price_3_23", "Price_4_9", "Shares"]].apply(pd.to_numeric)

4.2. Adding Market Cap data and percentage change of stock prices¶

Adding Market Cap Data¶

Next, we will add the market cap in the 3 different dates.

stocks_df["Marketcap_1_1"] = stocks_df["Price_1_1"] * stocks_df["Shares"]

stocks_df["Marketcap_3_23"] = stocks_df["Price_3_23"] * stocks_df["Shares"]

stocks_df["Marketcap_4_9"] = stocks_df["Price_4_9"] * stocks_df["Shares"]

Adding percentage change of stock prices¶

# Percentage Change from January 1st to March 23rd

stocks_df["PercentageChange_3_23_1_1"] = (stocks_df["Price_3_23"] - stocks_df["Price_1_1"]) / stocks_df["Price_1_1"]*100

# Percentage Change from March 23rd to April 9th

stocks_df["PercentageChange_4_9_3_23"] = (stocks_df["Price_4_9"] - stocks_df["Price_3_23"]) / stocks_df["Price_3_23"]*100

# # Percentage Change from January 1st to April 9th

stocks_df["PercentageChange_4_9_1_1"] = (stocks_df["Price_4_9"] - stocks_df["Price_1_1"]) / stocks_df["Price_1_1"]*100

4.3. Analyzing the data¶

Change in the total market cap of the S&P 500¶

sum(stocks_df["Marketcap_3_23"] - stocks_df["Marketcap_1_1"]) / 10**9

-8713.69057696208

sum(stocks_df["Marketcap_4_9"] - stocks_df["Marketcap_3_23"]) / 10**9

4668.79088967648

sum(stocks_df["Marketcap_4_9"] - stocks_df["Marketcap_1_1"]) / 10**9

-4044.8996872855996

The S&P 500 lost 8.7 trillion USD from January 1st to March 23rd, but it got back 4.6 trillion from March 23rd to April 9th.

Change in the total market cap by sector¶

(stocks_df.groupby("GICS Sector").sum()["Marketcap_3_23"] - stocks_df.groupby("GICS Sector").sum()["Marketcap_1_1"]).sort_values() / 10**9

GICS Sector Information Technology -1592.206753 Financials -1518.712229 Industrials -1087.991664 Health Care -1031.715099 Consumer Discretionary -793.938427 Communication Services -734.977458 Energy -710.786571 Consumer Staples -450.846959 Real Estate -265.205780 Materials -264.696109 Utilities -262.613530 dtype: float64

At the 2020 bottom of the S&P 500 (March 23rd), the Information Technology and Financials sectors had the largest drop in total market cap (compared to January 1st) with 1.592 trillion and 1.518 trillion respectively.

(stocks_df.groupby("GICS Sector").sum()["Marketcap_4_9"] - stocks_df.groupby("GICS Sector").sum()["Marketcap_1_1"]).sort_values() / 10**9

GICS Sector Financials -870.187706 Industrials -691.882829 Information Technology -559.803630 Energy -510.373229 Communication Services -401.445690 Consumer Discretionary -397.755029 Health Care -269.510749 Consumer Staples -138.054799 Materials -110.571043 Real Estate -55.584791 Utilities -39.730193 dtype: float64

As of April 9th, we can see that the Financials and Industrials sector had the largest drop in total market cap compared to January 1st.

Ranking of companies by percentage change of stock prices¶

stocks_df.sort_values(by=["PercentageChange_4_9_1_1"])[["Security", "PercentageChange_4_9_1_1"]].head(5)

| Security | PercentageChange_4_9_1_1 | |

|---|---|---|

| index | ||

| 352 | Norwegian Cruise Line Holdings | -77.715451 |

| 90 | Carnival Corp. | -75.794192 |

| 409 | Royal Caribbean Cruises Ltd | -70.129967 |

| 303 | Marathon Oil Corp. | -69.883041 |

| 346 | Noble Energy Inc | -68.876917 |

We can see from the table above that the companies that are hardest hit are the 3 major cruises companies: Norwegian Cruise Line Holdings, Carnival Corp., Royal Caribbean Cruises Ltd. These companies saw drops in their stock price of over 70%.

print(sum(stocks_df["PercentageChange_4_9_1_1"] < 0))

print(sum(stocks_df["PercentageChange_4_9_1_1"] > 0))

449 56

Only 56 stocks form the 505 saw positive growth from January 1st to April 9th.

Percentage Change of stock priced by sector¶

stocks_df.groupby("GICS Sector").mean()['PercentageChange_4_9_1_1'].sort_values()

GICS Sector Energy -49.838483 Consumer Discretionary -32.364198 Financials -25.090248 Industrials -23.928685 Communication Services -20.003368 Materials -17.806975 Information Technology -15.412405 Real Estate -14.374746 Health Care -8.395149 Consumer Staples -8.243594 Utilities -6.477197 Name: PercentageChange_4_9_1_1, dtype: float64

We can see that the energy sector was the hardest hit with a 49.8% average drop in stock prices.

Below we can visualize a boxplot of the 11 sectors' percentage change in stock prices from January 1st to April 9th.

plt.figure(figsize=(18, 6))

plt.tick_params('both', labelsize='8')

plt.xticks(rotation=45)

sns.boxplot(x="GICS Sector", y="PercentageChange_4_9_1_1", data=stocks_df)

<matplotlib.axes._subplots.AxesSubplot at 0x12427a6a0>

stocks_df.groupby("GICS Sub Industry").mean()['PercentageChange_4_9_1_1'].sort_values()

GICS Sub Industry

Hotels, Resorts & Cruise Lines -61.709685

Oil & Gas Equipment & Services -58.043026

Oil & Gas Drilling -57.631986

Airlines -53.542246

Department Stores -53.265702

...

Food Retail 8.374040

Wireless Telecommunication Services 9.301438

Metal & Glass Containers 9.486537

Water Utilities 9.608985

Gold 32.600648

Name: PercentageChange_4_9_1_1, Length: 128, dtype: float64

print(sum(stocks_df.groupby("GICS Sub Industry").mean()['PercentageChange_4_9_1_1'] < 0))

print(sum(stocks_df.groupby("GICS Sub Industry").mean()['PercentageChange_4_9_1_1'] > 0))

118 10

if we look at the average percentage change in stock prices by Sub Industry; we can see that the travel related industries, Oil & Gas and Department Stores were the hardest hit. 118 of the 138 Sub Industries had their average stock price declined from January 1st to April 9th.

plt.figure(figsize=(18, 6))

plt.tick_params('both', labelsize='8')

stocks_df.groupby("GICS Sub Industry").mean()['PercentageChange_4_9_1_1'].sort_values().plot.bar()

<matplotlib.axes._subplots.AxesSubplot at 0x1279d2b70>

Percentage Change of stock priced by sector (From March 23rd to April 9th)¶

stocks_df.groupby("GICS Sector").mean()['PercentageChange_4_9_3_23'].sort_values()

GICS Sector Communication Services 17.908378 Consumer Staples 21.212689 Information Technology 22.503612 Health Care 28.291532 Industrials 28.485595 Consumer Discretionary 33.247166 Utilities 35.572216 Financials 35.613067 Real Estate 36.756680 Materials 36.822111 Energy 44.655048 Name: PercentageChange_4_9_3_23, dtype: float64

Percentage Change of stock priced by Sub Industry (From March 23rf to April 9th)¶

stocks_df.groupby("GICS Sub Industry").mean()['PercentageChange_4_9_3_23'].sort_values()

GICS Sub Industry

Food Retail -0.064350

Drug Retail 0.848429

Hypermarkets & Super Centers 5.825800

Interactive Home Entertainment 8.869739

Hotel & Resort REITs 11.516854

...

Copper 51.948052

Real Estate Services 52.899765

Diversified Chemicals 55.535296

Distributors 62.086331

Household Appliances 63.111180

Name: PercentageChange_4_9_3_23, Length: 128, dtype: float64

All sectors and sub industries (except Food Retail) saw their average stock price go up from March 23rd to April 9th.

Conclusion¶

In this tutorial, we learned how to use Python, Google Sheets and Google Finance to collect and analyze stock data in the context of coronavirus pandemic. We're still in the early stages of the pandemic, and we don't know yet what would be the mid to long term effect of the pandemic on both the society and the economy. It would be interesting to review this analysis in the coming weeks to see if the stock market recovers from the 2020 losses.

The source code for this tutorial can be found in this github repository.